To collect unpaid taxes, the New York State Department of Taxation and Finance is allowed to garnish 10% of your pay - this means the State can contact your Employer and legally attach your Salary. Unfortunately, this wasn’t enough for the State - so after some late-night wrangling and some old-fashioned politicking, our elected officials decided to give the Tax Department Carte Blanche.

When you consider how bad the economy has been, and when you consider how high our taxes actually are - it’s not surprising that so many people nowadays have tax problems, said David Selig during a recent nationally televised interview.

These levels of enforcement are known as the “Three P’s” The Peck, The Punch and The Pulverizer.

When you consider how bad the economy has been, and when you consider how high our taxes actually are - it’s not surprising that so many people nowadays have tax problems, said David Selig during a recent nationally televised interview.

Unfortunately, most Tax Collectors think you’re a Criminal. Accordingly, if you’ve fallen behind with your taxes, most Tax Collectors are going to treat you like a criminal, says Bradley Dorin of Selig and Associates.

In fact, behind closed doors Tax Collectors use their own “clandestine code” when determining just how punitive your punishment should be. For example, there are three levels of enforcement that most Tax Collectors unilaterally dispense.

For your edification we have provided the definition of each level.

The Peck: The Tax Department garnishes 10% of your gross salary.

The Peck: The Tax Department garnishes 10% of your gross salary.

The Punch: The Tax Department garnishes 10% of your gross salary and levies 100% of your Bank Account (this means you won’t have a dime – you can’t pay the rent; you can’t buy food - you can’t even afford to get to and from work – People who are “punched” typically lose their automobiles through repossession, and watch helplessly while their good credit is destroyed).

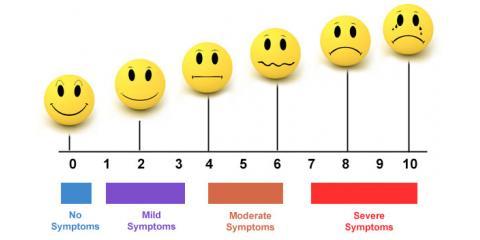

The Pulverizer: The Tax Department repeatedly levies every bank account and simultaneously revokes your Drivers License (this means you eventually default on your mortgage or are evicted from your apartment - plus all the unpleasantness catalogued in the Punch – People who are “Pulverized” experience marital problems viz. separation and divorce and extreme emotional distress a/k/a “TAD” taxpayer anxiety disorder.

The Pulverizer: The Tax Department repeatedly levies every bank account and simultaneously revokes your Drivers License (this means you eventually default on your mortgage or are evicted from your apartment - plus all the unpleasantness catalogued in the Punch – People who are “Pulverized” experience marital problems viz. separation and divorce and extreme emotional distress a/k/a “TAD” taxpayer anxiety disorder.

To Date, Taxpayer Anxiety Disorder has contributed to over 100,000 Suicides

Why won’t the IRS and State allow non-filers back into the fold without the fear of penalty or prosecution? As a Tax Practitioner and Advocate, I’ve seen so many good peoples lives ruined by taxes. And when it comes to submitting to governmental authority (filing taxes, etc.,) these same people become emotionally debilitated.

Over the past three years, my colleague Attorney Bradley Dorin has done extensive research on this very subject. In fact, after consulting with several psychologists and psychiatrists, we have come to believe that this condition “Taxpayer Anxiety Disorder” is a derivation of generalized anxiety disorder.

This notwithstanding, I’m not a medical professional - so I’ll limit my opinions to taxes. Accordingly, by not prosecuting or otherwise penalizing people with TAD, the government would save approximately 750 Million Dollars each year in ineffective enforcement costs (and simultaneously receive billions in previously uncollected taxes). For example, when the government prosecutes an individual for tax evasion, it’s not uncommon for that person to bankrupt himself (which makes the government’s judgments worthless).

Moreover, when the government wins a conviction, the taxpayer is stuck picking up the tab - and an otherwise productive person languishes away in prison and contributes nothing to society. Of course, the government doesn’t always win, and as such, all of the money and resources were wasted. Alternatively, by bringing these same people into compliance, the government will receive in excess of 80 Billion Dollars a year in revenues, that are presently going unreported (this amount represents approximately 6% of revenues received from individual 1040 filers). To be continued . . . .

Selig & Associates, Inc. in New York, NY

We're committed to bettering the community in which we practice. This is why David Selig and Bradley Dorin have from time to time agreed to waive or reduce their fees. In this capacity, they’ve helped Veterans, nonprofits, members of the clergy, the wrongly accused, the LGBT community, indigents, seniors, urban daycare centers and prisoners in state and federal correctional institutions. If you have a tax problem that you’d like us to consider, either as a pro bono or as a reduced rate client or if you’d like to support our efforts in this challenging forum, call us directly.

Originally Posted: http://nearsay.com/c/11866/11728/ny-tax-department-to-public-peck-punch-pulverize-taxpayer-anxiety-disorder-linked-to

Why won’t the IRS and State allow non-filers back into the fold without the fear of penalty or prosecution? As a Tax Practitioner and Advocate, I’ve seen so many good peoples lives ruined by taxes. And when it comes to submitting to governmental authority (filing taxes, etc.,) these same people become emotionally debilitated.

Over the past three years, my colleague Attorney Bradley Dorin has done extensive research on this very subject. In fact, after consulting with several psychologists and psychiatrists, we have come to believe that this condition “Taxpayer Anxiety Disorder” is a derivation of generalized anxiety disorder.

This notwithstanding, I’m not a medical professional - so I’ll limit my opinions to taxes. Accordingly, by not prosecuting or otherwise penalizing people with TAD, the government would save approximately 750 Million Dollars each year in ineffective enforcement costs (and simultaneously receive billions in previously uncollected taxes). For example, when the government prosecutes an individual for tax evasion, it’s not uncommon for that person to bankrupt himself (which makes the government’s judgments worthless).

Moreover, when the government wins a conviction, the taxpayer is stuck picking up the tab - and an otherwise productive person languishes away in prison and contributes nothing to society. Of course, the government doesn’t always win, and as such, all of the money and resources were wasted. Alternatively, by bringing these same people into compliance, the government will receive in excess of 80 Billion Dollars a year in revenues, that are presently going unreported (this amount represents approximately 6% of revenues received from individual 1040 filers). To be continued . . . .

Selig & Associates, Inc. in New York, NY

We're committed to bettering the community in which we practice. This is why David Selig and Bradley Dorin have from time to time agreed to waive or reduce their fees. In this capacity, they’ve helped Veterans, nonprofits, members of the clergy, the wrongly accused, the LGBT community, indigents, seniors, urban daycare centers and prisoners in state and federal correctional institutions. If you have a tax problem that you’d like us to consider, either as a pro bono or as a reduced rate client or if you’d like to support our efforts in this challenging forum, call us directly.

Originally Posted: http://nearsay.com/c/11866/11728/ny-tax-department-to-public-peck-punch-pulverize-taxpayer-anxiety-disorder-linked-to

0 comments:

Post a Comment